Each state has laws requiring employers to compensate employees for injuries that happen on the job. Most employers comply with these laws by purchasing workers' compensation insurance from an insurance company.

Self-insureds must comply with these same workers' compensation laws. What sets self-insureds apart is that they've taken the responsibility for paying their own claims. There are many reasons why employers might choose to become self-insured for workers' compensation.

The services available to self-insureds provide good answers to these questions.

Not many self-insureds handle their own claims. Claims service companies specialize in providing claims administration and loss control services for self-insureds. They contract with self-insureds to provide these services for an agreed fee. Depending on the region, these firms may be called service companies, third party administrators (TPA's) or claims administrators.

two ways

a self-insured can suffer

bad loss experience:

This coverage protects self-insureds against:

The unexpected catastrophic loss

Specific Excess Insurance

The unexpected frequency of claims

Aggregate Excess Insurance

Note: In some regions, this coverage is called "reinsurance" and some state insurance departments classify it as reinsurance.

Might Choose to Become Self-Insured for Workers' Comp:

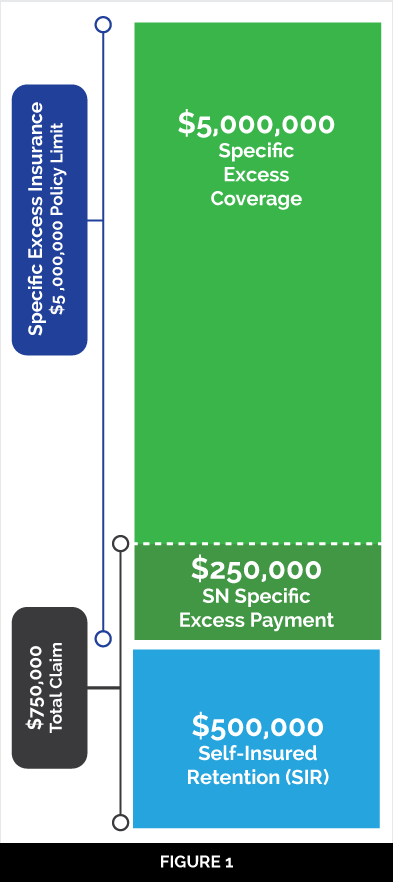

All states allow (and most require) self-insureds to purchase specific excess insurance coverage. It limits the amount a self-insured pays for claims from any one occurrence. The amount the self-insured is responsible for is called the Self-Insured Retention, or SIR. Specific excess insurance reimburses the self-insured when a claim or claims resulting from one occurrence exceed the SIR. As an example (see Figure 1), if the SIR is $500,000 and a claim occurs that totals $750,000 the specific excess pays $250,000.

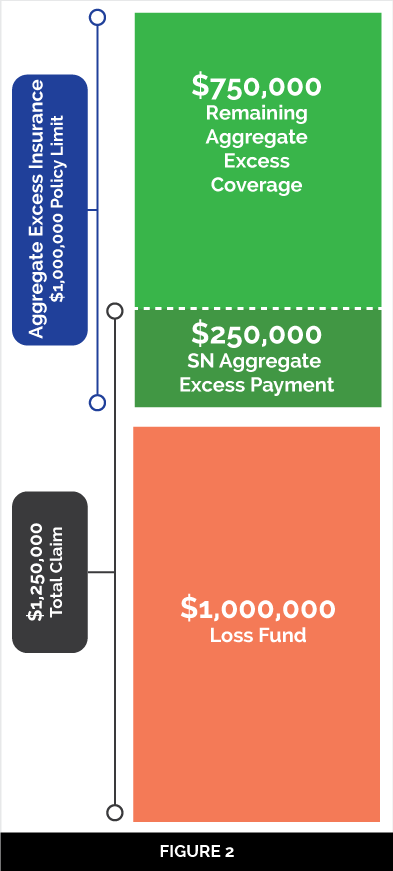

While specific excess insurance protects against the unusually large or “catastrophic” claim, aggregate excess insurance protects against the unusually heavy year of claims. An unusually heavy year of claims could be the result of several large claims or an accumulation of many smaller claims. There is a good chance it would be a combination of the two.

To protect themselves against the possibility that one year’s claims could be significantly worse than usual, many self-insureds purchase aggregate excess insurance. In purchasing aggregate excess, the attachment point is negotiated with an excess insurance company (usually the same excess carrier providing the specific excess insurance). This attachment point is called the Aggregate Retention or the Loss Fund. The Loss Fund is the amount the self-insured must pay in claims before the aggregate excess begins to pay.

Let’s say ABC Company and their insurance broker negotiate with an excess insurance carrier and agree on a loss fund of $1,000,000. ABC Company will have to pay out that amount ($1,000,000) before the aggregate excess coverage begins to pay.

The loss fund is usually expressed as a percentage of the workers’ compensation manual premium.

For example:

ABC Company has a workers’ compensation manual premium of $800,000. The $1,000,000 loss fund would be expressed as a 125% loss fund ($800,000 x 125%). By “pegging” the loss fund to the workers’ compensation manual premium, payroll increases during the policy period will translate into an increase in the loss fund. In our example, if ABC Company ended the policy period with an audited workers’ compensation premium of $850,000, then their loss fund would be $1,062,500 (850,000 x 1.25 = 1,062,500).

A commonly asked question is, “Can the loss fund be used up by one large claim?” The answer is “no”, because only the amount actually paid by the self-insured applies towards the loss fund.

Let’s say that ABC Company carries specific excess coverage with an SIR of $500,000 and they have a $750,000 claim. Only the $500,000 that ABC pays on this claim will apply towards satisfying the loss fund. The $250,000 paid by the specific excess carrier does not apply towards the loss fund.

Remember, aggregate excess coverage is sleep insurance. It gives self-insured employers a limit on the cost of claims over a given period of time.

In Figure 2, we’ve shown an example of aggregate excess coverage. In the example, the self insured employer had a loss fund of $1,000,000. Their claims for the year totaled $1,250,000. In this example the aggregate coverage would respond for the excess amount of $250,000.

Sometimes excess underwriters will offer a two year aggregate program. The two year aggregate attachment will usually be less than twice the one year attachment, giving the insured employer a lower loss fund for the two year period.

For example, if ABC Company felt the $1,250,000 loss fund was higher than it wanted, the excess underwriters might offer a two year loss fund of $2,000,000 which would be closer to what ABC expected for two years of losses.

Finally, both specific and aggregate excess coverage written together can provide the self-insured employer with strong safeguards against the catastrophic occurrence (specific excess) and the unusually heavy frequency of claims (aggregate excess).

The answer is "no", because only the amount actually paid by the self-insured applies towards the loss fund.