Self-Insurance (Text Only Version)

Why Self-Insurance?

With workers’ compensation costs rising, more and more large employers are considering self-insurance. Certain kinds of losses can be predictable and self-insurance is a more efficient way to pay for those losses.

Reduced costs can come from several areas, including:

- Lower fixed costs (program administration)

- Improved claims management

- Reduced losses through better loss control

- Improved cash flow

In addition, the self-insured employer gains more overall control of claims and receives more detailed claims information from the claims administrator.

Self-Insurance: How it Works

Each state has laws requiring employers to compensate employees for injuries that happen on the job. Most employers comply with these laws by purchasing workers’ compensation insurance from an insurance company.

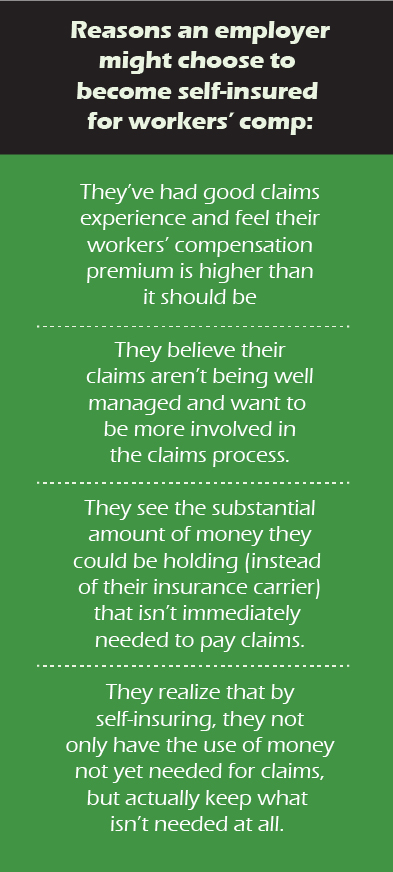

Self-insureds must comply with these same workers’ compensation laws. What sets self-insureds apart is that they’ve taken the responsibility for paying their own claims. There are many reasons why employers might choose to become self-insured for workers’ compensation.

Whatever the reasons, a self-insured has decided they can benefit more by taking this responsibility into their own hands than by purchasing workers’ compensation coverage from an insurance company.

At this point, potential self-insureds usually have two concerns:

- What do we know about handling workers’ compensation claims?

- If we have a really bad claim, won’t we go broke?

The services available to self-insureds provide good answers to these questions.

Not many self-insureds handle their own claims. Claims service companies specialize in providing claims administration and loss control services for self-insureds. They contract with self-insureds to provide these services for an agreed fee. Depending on the region, these firms may be called service companies, third party administrators (TPA’s) or claims administrators.

There are two ways a self-insured can suffer bad loss experience: a single large claim or an unusually large number of claims during a year.

To limit the amount of money paid out in these situations, most self-insureds purchase excess workers’ compensation insurance. This coverage protects self-insureds against the unexpected catastrophic loss (Specific Excess Insurance) or the unexpected frequency of claims (Aggregate Excess Insurance).

Note: In some regions, this coverage is called “reinsurance” and some state insurance departments classify it as reinsurance.

Specific Excess Insurance

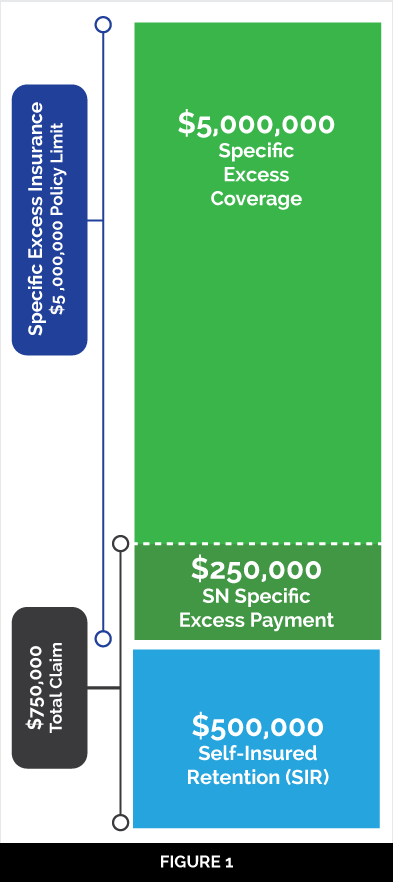

All states allow (and most require) self-insureds to purchase specific excess insurance coverage. It limits the amount a self-insured pays for claims from any one occurrence. The amount the self-insured is responsible for is called the Self-Insured Retention, or SIR. Specific excess insurance reimburses the self-insured when a claim or claims resulting from one occurrence exceed the SIR. As an example (see Figure 1), if the SIR is $500,000 and a claim occurs that totals $750,000 the specific excess pays $250,000.

Aggregate Excess Insurance

While specific excess insurance protects against the unusually large or “catastrophic” claim, aggregate excess insurance protects against the unusually heavy year of claims. An unusually heavy year of claims could be the result of several large claims or an accumulation of many smaller claims. There is a good chance it would be a combination of the two.

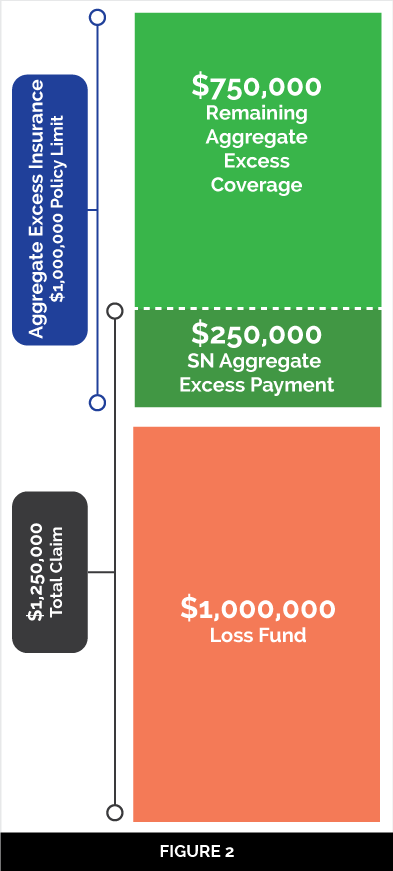

To protect themselves against the possibility that one year’s claims could be significantly worse than usual, many self-insureds purchase aggregate excess insurance. In purchasing aggregate excess, the attachment point is negotiated with an excess insurance company (usually the same excess carrier providing the specific excess insurance). This attachment point is called the Aggregate Retention or the Loss Fund. The Loss Fund is the amount the self-insured must pay in claims before the aggregate excess begins to pay.

Let’s say ABC Company and their insurance broker negotiate with an excess insurance carrier and agree on a loss fund of $1,000,000. ABC Company will have to pay out that amount ($1,000,000) before the aggregate excess coverage begins to pay.

The loss fund is usually expressed as a percentage of the workers’ compensation manual premium.

For example:

ABC Company has a workers’ compensation manual premium of $800,000. The $1,000,000 loss fund would be expressed as a 125% loss fund ($800,000 x 125%). By “pegging” the loss fund to the workers’ compensation manual premium, payroll increases during the policy period will translate into an increase in the loss fund. In our example, if ABC Company ended the policy period with an audited workers’ compensation premium of $850,000, then their loss fund would be $1,062,500 (850,000 x 1.25 = 1,062,500).

A commonly asked question is, “Can the loss fund be used up by one large claim?”

The answer is “no”, because only the amount actually paid by the self-insured applies towards the loss fund.

Let’s say that ABC Company carries specific excess coverage with an SIR of $500,000 and they have a $750,000 claim. Only the $500,000 that ABC pays on this claim will apply towards satisfying the loss fund. The $250,000 paid by the specific excess carrier does not apply towards the loss fund.

Remember, aggregate excess coverage is sleep insurance. It gives self-insured employers a limit on the cost of claims over a given period of time.

In Figure 2, we’ve shown an example of aggregate excess coverage. In the example, the self insured employer had a loss fund of $1,000,000. Their claims for the year totaled $1,250,000. In this example the aggregate coverage would respond for the excess amount of $250,000.

Sometimes excess underwriters will offer a two year aggregate program. The two year aggregate attachment will usually be less than twice the one year attachment, giving the insured employer a lower loss fund for the two year period.

For example, if ABC Company felt the $1,250,000 loss fund was higher than it wanted, the excess underwriters might offer a two year loss fund of $2,000,000 which would be closer to what ABC expected for two years of losses.

Finally, both specific and aggregate excess coverage written together can provide the self-insured employer with strong safeguards against the catastrophic occurrence (specific excess) and the unusually heavy frequency of claims (aggregate excess).

Steps to Self-Insurance

We’ve listed some principle steps to becoming self-insured. While it’s not necessary to follow these in order, the information gathered for the feasibility study is important to the remaining steps.

The Feasibility Study

An insurance broker, insurance consultant or claims administrator can assist you with a feasibility study. The Feasibility Study looks at the past claims, payrolls, and premiums, and develops “expected” claim levels for future years. When completed, the feasibility should answer the question, “Do the numbers work for us?”

State Approval

Each state regulates who may be self-insured for workers’ compensation. Normally, a prospective self-insured submits a required application accompanied by audited financial data, prior workers’ compensation loss history, and other information required by the individual states. The state will then approve or disapprove the application. Your insurance broker, insurance consultant, or claims administrator can help you with this application process.

Selection of Claims Administrator

The success of any self-insurance program partly depends on the work of the claims administrator. A good third party administrator becomes an extension of your company and plays a key role in managing claim dollars. Interview several prospective service companies to discover claim management philosophies, background of staff and details about data system and reports, etc. When it comes time to make a choice, consider it a professional service and don’t choose by price alone.

Loss Control

For self-insurance to really work, there must be a strong commitment to loss control. Whether you have inside loss control staff or use an outside loss control service, there must be a commitment to making your workplace as safe as possible.

Excess Workers’ Compensation Insurance

We’ve explained how the excess coverage works. Your insurance broker or TPA can help you obtain quotes and discuss with you what limits and self-insured retention to consider.

State Security Requirement

All states require a bond or letter of credit from self-insureds to guarantee payment of claims in the event the employer is unable to pay. If you chose a letter of credit, you will need to work with the state regulator and your banker. If you choose a bond (required by many states), the insurance broker or TPA working on your excess quotes can help you obtain a bond quote.

Self-Insurance Costs

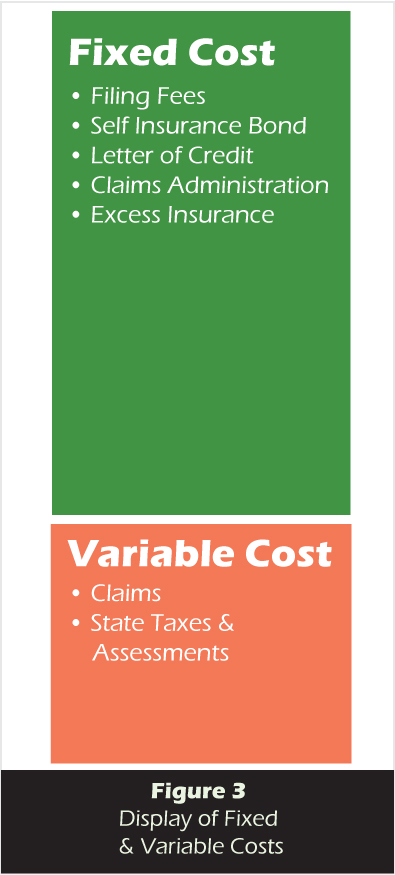

Self-insurance costs fall into two categories, fixed and variable. These costs closely parallel the cost components of an insured program. But with a self-insured program you are paying the bills and will know what the individual costs are. To estimate your costs, you will need to know your workers’ compensation standard premium and prior year’s losses, both paid and reserved.We have described the usual fixed and variable costs below as well as displayed them in Figure 3. Remember these are examples of costs typically found in self-insured programs. Your actual costs will vary depending on your individual experience, your state, and other factors.

Fixed Costs

- State application or filing fees: these will vary from $100 to over $1,000.

- Self-insurance bond: $15 to $45 per $1,000 of bond amount.

- Letter of Credit: 1% to 2% of amount of LOC (each state requires a bond or LOC as assurance that funds will be available to pay future claims).

- Claims administration and loss control: 8% to 13% of standard workers’ compensation premium (often charged “per claim”).

- Excess insurance: 9% to 13% of standard workers’ compensation premium (combined specific and aggregate coverage).

Variable Costs

- Claims: paid as necessary. A qualified broker or insurance consultant can help you project estimated future claim costs based on your past experience.

- State taxes and assessments: these also may vary by state, but are usually 1% to 4% of either incurred or paid losses or manual workers’ compensation premium. In some states, these are a set amount and would be in the “fixed cost” category.

What is Needed?

Listed below is the information most likely to be requested by your state, the firm doing your feasibility study, prospective claims administrators, excess workers’ compensation underwriters and bond underwriters asked to provide quotations.

While you may be asked to complete a specific application or form, the information requested will typically be the same as we’ve listed below.

For The Feasibility Study

- Workers’ compensation claims data for the most recent five to ten years.

- Payroll data for the most recent five to ten years.

- Workers’ compensation premiums for the most recent five to ten years.

For the State Self-Insurance Permit

- Audited financial data for past several years.

- A general history of your firm or organization.

- Information relative to the ownership of your firm.

- Workers’ compensation claims data for the most recent three to five years.

- Information about your loss control program.

- The names of your probable claims administrator and excess workers’ compensation insurer.

For The Claims Administrator/Service Company

- Copies of actual workers’ compensation claim printouts (called “loss runs”) showing both the dollar amount of the claims and the number of claims.

- General information about your organization, including number of locations and employees, and size of payrolls.

- Information regarding your expectations for a loss control program and your desires for frequency of claims reports.

- Your desired involvement in the claims process, such as regular meetings to review large claims, etc.

For An Excess Workers’ Compensation Underwriter

- Five to seven years prior workers’ compensation and losses and premium, including your workers’ compensation experience modification worksheets, if available. The insurance broker or TPA working with the excess underwriter(s) can help you prepare this information.

- Five to seven years prior payroll data (insurance company audits are best) and have budgeted payrolls for the coming year.

- Details on any workers’ compensation claim larger than $100,000.

- General information on your firm, its history, etc.

- Information on the use of any watercraft or any owned, leased, or chartered aircraft.

- The name(s) of prospective claims service companies.

For The Bond Underwriter

- Three years audited financial statements, plus interim financial statements for the current year.

- Banking references.

- General background of your organization.