How to Stop the Madness: Violence in the Workplace

Every day in the United States, someone dies in an incident related to workplace violence, however, only 70 percent of U.S. businesses have a workplace violence plan – many of which are incomplete and untested. Workplace violence should be at the top of your vulnerability and threat analysis. This RIMS 2016 session illustrated how to mitigate this risk by properly implementing the Behavioral Risk & Threat Assessment (BeRThA™) program. Speakers included: Suzanne Rhulen Loughlin, Founder/EVP/CAO, Firestorm Solutions, LLC Harry Rhulen, CEO, Firestorm Solutions, LLC People do not just snap. There are warning signs, red flags, cues, signals – but often

(Read the full article…)

The Next Nightmare? Be on the Lookout for These Emerging D&O Claim Trends

The speakers in this RIMS 2016 session were: Jimmy Kirtland, VP, Corporate Risk Management, Voya Financial Aloysius Tan, Data Analyst, Advisen Four directors and officers (D&O) claim trends have grown in significance. Drivers of these trends include regulatory changes – the most major trend, shift in the focus in terms of prosecution, plaintiff’s bar identifying new sources of revenue and response by corporate defense bar. The four claims trends that are emerging and were presented include: Patent infringement – prohibits the unauthorized use of a patented invention and is covered by title 35 of the US code. Here D&Os are

(Read the full article…)

Deal or No Deal: Strategies for Effective Management of Public Safety Officer Claims

Safety officer claims for work-related injuries are unique and expensive, thus it is important to effectively manage these claims. The RIMS 2016 speakers for this session were: Diane Caminite, Risk & Safety Manager, San Diego Unified Port District Susan Hastings, Partner, Laughlin, Falbo, Levy & Moresi This session’s speakers are from California and talked about labor code 4850 under Workers’ Compensation. Here, when a safety officer is injured and unable to work, labor code 4850 comes into play. After qualification, the 4850 salary continuation benefit will provide full salary for up to a year among other benefits. Special presumptive injuries

(Read the full article…)

Managing Unique Risks Posed by Unmanned Aircraft Systems

The speakers in this RIMS 2016 session were: James Van Meter, Aviation Practice Leader, Allianz Global Corporate & Specialty Mark Lauderbaugh, Director, Risk Management, Crown Castle International Corp. With over 4,000 FAA approved small unmanned aircraft systems used in commercial operations and an average of 50 new ones per week, the FAA estimates that by 2020 there will be about 30,000 unmanned aircraft systems (UAS) used for business purposes. In addition, there are over 400,000 registered hobby users. Integration of UAS is a top priority and the FAA is finalizing rules for commercial UAS operations. Companies and their clients can be exposed to

(Read the full article…)

Measuring the Value of Risk Management

Being a risk manager can be a thankless job and may also lead to becoming a scapegoat when things go wrong. You cannot prove a negative and there is only a chance that something is going to happen, so when it doesn’t, is that a result of good risk management? In this RIMS 2016 session, Rodney Farrar, Director at Paladin Risk Management, explained how to demonstrate the successes of your risk management programs to get the proper credit you deserve. The task of measuring the benefits risk management brings to an organization is a challenging one. Unlike finance or human

(Read the full article…)

Insurance M&A – The Rapidly Changing Landscape

At the 2016 RIMS Annual Conference, Grace Vandecruze from Grace Global Capital LLC presented a session discussing M&A trends in the insurance industry. There are several factors currently impacting M&A activity in the insurance marketplace: Prolonged low interest rate environment Competitive landscape Low equity valuations of many companies Strong cash positions, excess capital Foreign buyers Private equity Regulatory uncertainty Geopolitical risk Shareholder activism In the P&C industry, when you compare 2005 to 2015 you still see basically the same market share controlled by larger companies with around 54% of the marketplace outside those larger companies. In the life marketplace we

(Read the full article…)

Brokerage Executives Discuss Industry Trends

This RIMS 2016 panel gathered senior industry executives from brokerage firms to weigh in on issues within the insurance marketplace. Panelists included: Todd Jones, Co-Head North America, Willis Towers Watson Donald Bailey, President, Global Sales, Marsh J. Patrick Gallagher, Chairman, President & CEO, Arthur J. Gallagher & Co. Steve McGill, Group President, Aon PLC Don Bailey, what are the current threats posed to brokers today? Too many of our conversations with clients are dominantly focused on price of product. We have to pivot conversations to conversations of risk, rather than price. If we don’t make that transition, we are going

(Read the full article…)

Insurance Carrier Executives Debate Emerging Issues

This RIMS 2016 panel gathered senior executives from insurance carriers to discuss what they believe are the emerging issues in the insurance marketplace. Panelist included: John Lupica, Vice Chairman Chubb Ltd, President North America Major Accounts & Specialty Insurance, Chubb North America Peter Eastwood, President, Berkshire Hathaway Specialty Insurance Rob Schimek, CEO, Commercial, AIG Inga Beale, Chief Executive Officer, Lloyd’s of London Inga Beale, what challenges is the digital age posing for the insurance sector? We need to turn challenges into opportunities, but there is a lot going on in the world today. A recent study states 74% of insurance

(Read the full article…)

Cyber Liability and Directors’ and Officers’ Liability Insurance

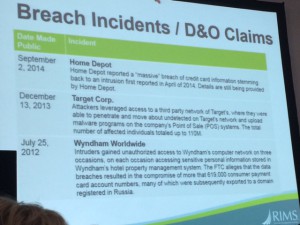

Cyber issues have become critical considerations for corporate boards and management teams as cyber incidents can result in a host of costs for regulatory investigations, remediation activities and credit monitoring. Speakers in this RIMS 2016 session included: Kieran Hughes, Vice President | Directors & Officers, AIG Timothy Fletcher, Senior Vice President and Team Leader, Aon Risk Solutions Leslie Lamb, Director, Global Risk Management, Cisco Systems, Inc. There were 1,500 data breaches in 2015. There have been several well-known recent breach incidents and resulting D&O claims in recent years. One most notable is Home Depot which reported a massive breach of

(Read the full article…)

Medicaid: The next MSP Compliance challenge

At the 2016 RIMS Annual Conference, a panel presented a session highlighting the latest challenges in Medicare Secondary Payer Compliance. The panel was: John Burkholder – Director Risk Management, Broward County Board of County Commissioners Cliff Connor – Vice President Medicare Compliance, Gallagher Bassett Services Roy Franco – Chief Legal Officer, Franco Signor LLC The expansion of Medicaid under the Affordable Care Act is leading to a new avenue of Medicare Secondary Compliance which is coming from the Medicaid side. Medicaid has always been a state administered program, but the Federal government pays a significant percentage of the claims. The

(Read the full article…)