Driving Insurance Forward: Insuring Autonomous Vehicle Risk

Autonomous vehicles may reduce the frequency of accidents, but they also present new liabilities. In this session at the RIMS 2019 Conference and Exhibition, Katherine Henry, Partner at Bradley Arant Boult Cummins LLP, discussed the anticipated shift of liability from owner or operator to manufacturer.

Coverage for Autonomous Vehicles

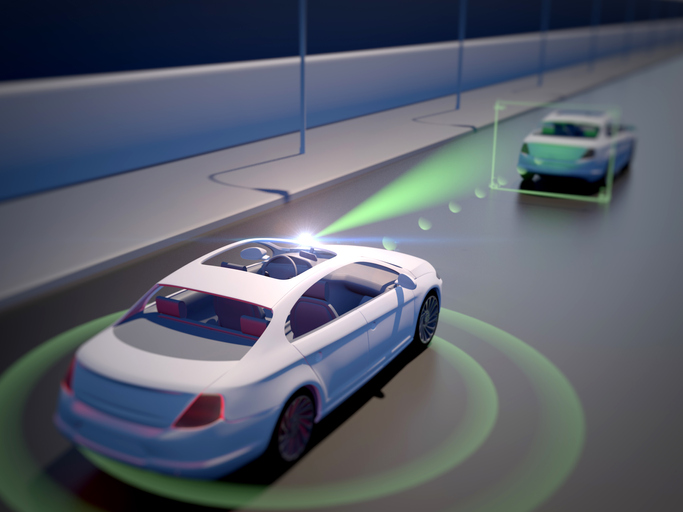

Since the automatic transmission was introduced in 1939, we have been marching toward autonomous vehicles. Today, the Department of Transportation recognizes five levels of automation for vehicles, ranging from partial automation to full automation, needing no driver assistance. Ford has announced that they will have their first fully autonomous vehicle in 2021, which will operate without a steering wheel, gas pedal or brake pedal. States are currently writing and passing regulatory legislation for these vehicles, but insurance coverage for fully autonomous vehicles will likely be different from the standard coverage forms we use now.

Consequences of Increased Automation

Ninety-four percent of accidents are caused by human error. Autonomous vehicles will drastically reduce driver risk. Frequency and severity will likely be reduced, but new risks, like Cyber exposure, will be introduced. Because some of these vehicles require little-to-no driver intervention, liability will shift from the driver to the manufacturer of the vehicle.

Methods to Address Evolving Risk

Traditional commercial auto policies will likely still cover vehicles that fall under the first four categories of automation. However, new types of coverage will be required for fully autonomous vehicles. These coverages will probably include a combination of liability and cyber coverages.