The Impact of Catastrophic Events on Workers’ Compensation

At the 2022 NCCI Annual Insights Symposium, Katherine Williamson from NCCI discussed the impact catastrophes have on workers’ compensation.

Understanding Past Events

There have been many past events that redefined workers’ compensation risk with the first being the Triangle Shirtwaist Fire in 1911. Workers’ compensation and many workplace safety laws arose after this.

In 1947, the port of Texas City in Galveston Bay was destroyed by multiple explosions. 581 were killed and thousands more were injured, highlighting the extraordinary potential impact of a workplace accident on workers’ compensation.

The September 11 attacks were the costliest workers’ compensation events ever with over $3 billion in losses paid. It also redefined how carriers and reinsurers viewed employee concentration risks.

NCCI classifies a catastrophic event as industry workers’ compensation losses over $50 million. There have been seven past events that NCCI classified as catastrophic for exceeding these losses; two were terrorist attacks, one was the pandemic, and the others were industrial explosions. In the event of a catastrophe, NCCI removes the losses from the rate-making data, so it does not unnecessarily distort the industry loss history.

Estimating Future Pandemic Risk

Before COVID-19, there was not sufficient data to properly estimate the potential impact of a pandemic on workers’ compensation. It was also thought that such illnesses would be treated like any other communicable disease and would not be covered under workers’ compensation. COVID-19 changed that with many states passing presumptive legislation mandating coverage under workers’ compensation.

To develop a pandemic model, NCCI took the following steps:

-

- Run Epidemiological Models

- Run models around the outbreak risk factors: how transmissible it is, the chances of fatality and the mutation rate.

- Human behavior must also be gauged, including global travel patterns, time until active containment and compliance with containment measures.

- Ecological factors including human/animal interaction and climate impact.

- Adjust Claim Counts

- This took into account rules around compensability, which kept evolving as states added presumptive legislation.

- Add Indemnity and Medical Losses

- Group health models were used for medical costs, and potential indemnity counts were added based on the impacted states.

- Determine Appropriate Granularity

- The model did not adjust for risk variations by occupation as they assumed prevailing rates would already account for this.

- Account for Extreme Events

- Run Epidemiological Models

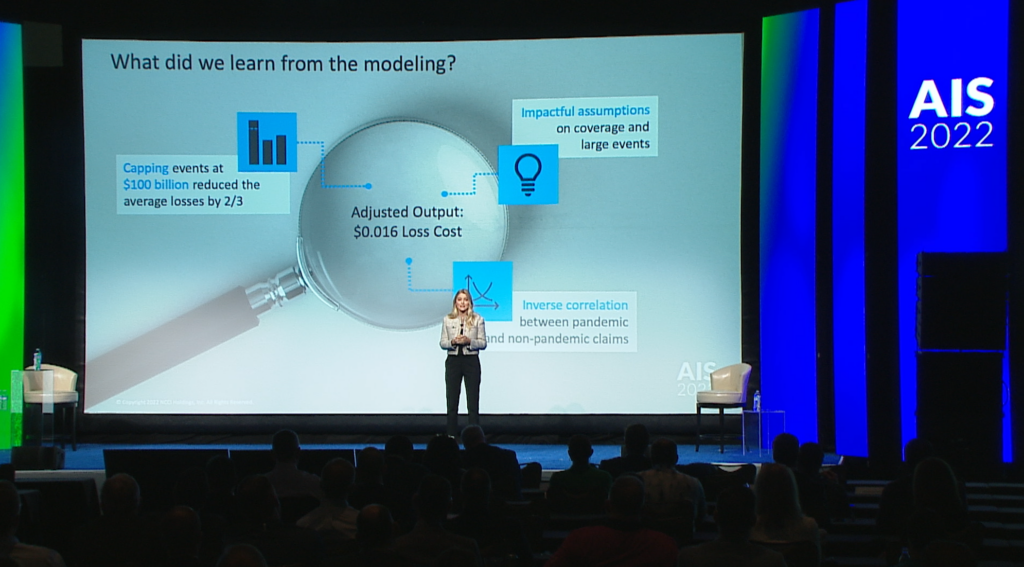

Implementing the Findings

There was an inverse correlation between pandemic and non-pandemic claims. As businesses closed, there were not less COVID-19 claims.