The Economy and Workers’ Compensation

At the 2018 NCCI Annual Issues Symposium, Robert Hartwig, Clinical Associate Professor of Finance at the University of South Carolina gave a fast-paced session highlighting the impact the economy is having on workers’ compensation. The highlights:

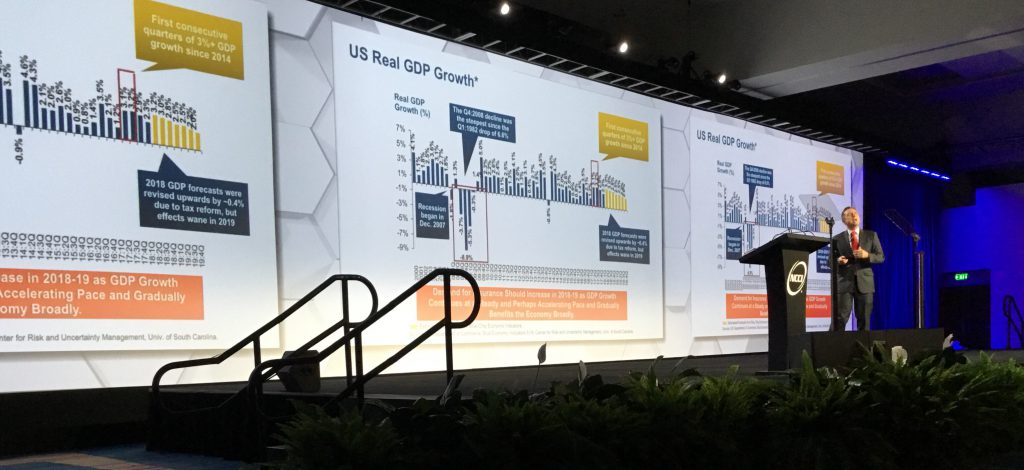

- Growth of workers’ compensation premiums is tied to growth in our economy and our economy is growing right now.

- Consumer confidence is the highest rate in nearly 20 years.

- Small business optimism is also extremely high right now.

- Business investment is a potential driver in premium growth.

- New private housing starts continue to climb. The construction industry is booming from the private sector standpoint. However, we are not seeing construction from the public sector as they are still financially challenged.

- Unemployment is at an 18 year low and payrolls have never been higher in the history of the United States.

- Unemployment and underemployment rates are still falling. The job market is operating as close to full employment as it ever has.

- All but 3 states and DC had unemployment rates below 5% as of March 2018.

- Hourly rates are increasing but slowly. With unemployment rates being low it is expected these rates will increase at a great pace.

- The long term unemployed is down over 81% compared to the peak following the economic crisis.

- Today there are 6.1 job openings unfilled. This means there are technically jobs available for every job seeker. At the height of the recession there was 1 job available for every 7 job seekers.

- Minimum wage rates are increasing around the nation with 18 states and 20 cities increasing their minimum wage in 2018. That has added over $5 billion in wages to the system, and these wages are subject to workers’ compensation payroll.

- Lower corporate tax rates benefit all insurers, but not equally. Companies that generate most of their income from underwriting income benefit the most. Carriers that were carrying significant Deferred Tax Assets had to write those down which caused a financial loss. Carriers more invested in corporate bonds than municipal bonds benefited because of the federal tax impact.

- P&C after tax industry income has been dropping for the last few years and is well below pre-recession levels. Workers’ compensation is outperforming other P&C lines, which is the reverse of what was seen 10 years ago.

- More than 60% of P&C investment is in bonds so changes in interest rates have a big impact on investment income. Investment income is still 10% below what it was pre-crisis as treasury yields are still climbing but are well below pre-crisis levels.

- The P&C industry has record surplus even after the year of record CAT losses. There is an expectation of higher M&A activity because of this.

- 10 year corporate bond rates have remained relatively flat for several years. And the spread between 2 year and 10 year bonds has shrunk considerably.

- The partial unraveling of the ACA is causing the uninsured rate to increase. We need to monitor the potential impact this could have on workers’ compensation.

- Inflation rates are higher but not out of control and the Fed is monitoring this closely.

- The U.S. national debt as a share of GDP has been climbing for years. Because of this the federal government is probably going to have to increase the yield rates on bonds to spur investment.

- Will the promised infrastructure spending actually happen? This would be very beneficial to the workers’ compensation industry. However, it does not appear there are funds available for this on the state/local/federal levels.

- One thing to watch is the potential for a trade war. If this happens it could lead to job losses in the United States.