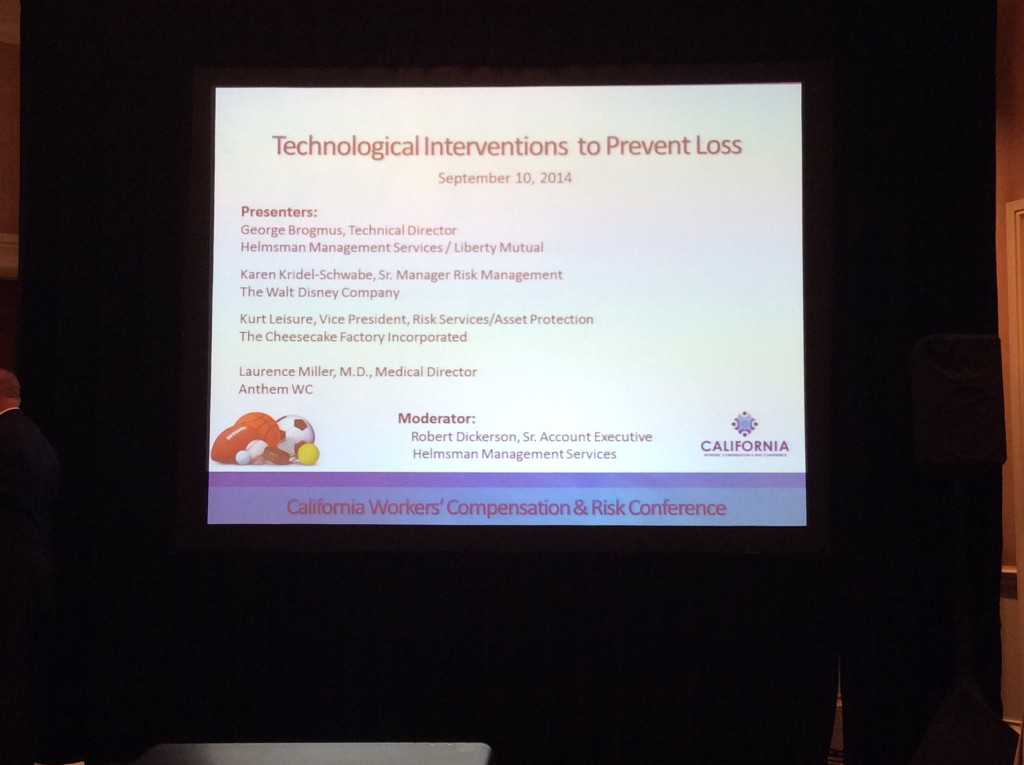

Technological Interventions to Prevent Loss

This session at the California Workers Comp & Risk Conference in Dana Point outlined projects that have successfully leveraged technology to provide timely, actionable changes that resulted in loss reduction.

Panelists included Karen Kridel-Schwabe, Senior Manager Risk Management at The Walt Disney Company, Kurt Leisure, VP Risk Services at The Cheesecake Factory, Robert Dickerson, Senior Account Executive at Liberty Mutual – Helmsman, George Brogmus, Technical Director at Liberty Mutual – Helmsman, and Dr. Laurence Miller, Medical Director at Anthem Workers’ Compensation.

Customized Flexible Audit Tool

This tool was originally developed and utilized throughout The Walt Disney Company to address operational challenges related to their retail stores. Challenges include remote locations throughout the U.S., multiple designs and floorplans, and a recent shift in safety culture and operational management when they bought back their retail stores from a previous owner who went backrupt.

The audit tool created automated reports (with weighted score), total fail questions, summarized non-compliant elements, offered ability to upload photo confirmations of findings, actionable pre-populated recommendations, credible observers, distribution of recommendations to responsible leadership.

Benefits of Tool:

• Able to produce a real-time risk assessment of multiple stores with different designs.

• Included self-modifying follow-up questions based on anwers entered into system.

• Provided quick ability to establish and send safety efforts.

• Able to confidentially route reports only to eyes needed.

Once the assessment questions were developed, risk control representatives went into stores (unannounced) and were asked to complete the assessment in under an hour, then transmit the report instantaneously to the appropriate parties.

They have been utilizing the audit tool for five years and are proud to report that audit scores continue to increase as they continue to raise bar and change questions. Costs have also decreased. They have since expanded the use of the audit tool to other Disney-owned TV stations, sporting and concert events, studio facilities at movie sets, and for ergonomic assessments.

Communicating Effectively with Generation Y

Utilized by The Cheesecake Factory who was challenged with communicating to an employee base with the average age of 25. They did a complete overhaul of their communications strategy, fully aware that, to communicate to this age group, e-mails must be short and to the point, and absorbtion of info is limited. Smart phones suddenly played a critical role in accident prevention.

The company changed their focus to communicate via methods like text messaging, interactive applications, short e-mails.

Safety Messaging:

• Short videos are a must, quality is not the most important aspect

• Social media is critical, so they developed “Cake Talk” that communicated corporate issues in a social media-type atmosphere. For instance, employees can post ideas and vote if they like or dislike an idea. Corporate can also comment directly to all posts.

Surveillance & Technology:

• New technology allows for fewer camaras that are higher resolution and provide face recognition software, that can be used to spot a difference in patterns (like a spill on the floor) and notifies the appropriate parties.

• It also provides remote monitoring to collect safety analytics.

• The company also uses secure file sharing to share data with business partners, which is mobile devise compatible and allows for collaboration (i.e. the ability to edit documents and files).

Predictive Analytics:

• The company’s analytics begins at the time of injury. During nurse triage, info is bouncing from their analytics and provides an immediate alert with recommendations on how to act to avoid a costly developmental claim.

• These analytics continue to run through the life of the claim, providing invaluable information.

Telemedicine

The argument was made for telemedicine, how it is directly applicable to workers’ compensation and and its ability to potentially offer significant cost savings.

Telemedicine (or telehealth) offers healthcare via the use of audio/visual tools rather than face-to-face care. According to the presenter, it provides easy access to care professionals at a signifcantly lower cost (much less than face-to-face medicine), it is HIPPA compliant, and, due to its ability to treat minor injuries, can offer great reduction of employer costs.

This can easily be applicable to workers’ compensation, like for pain management, where the doctor just needs to hear symptoms and diagnose next steps. It also works well for psych cases, cognitive behaviorable therapy, dematology (like treatment of burns), and closure of claims.

Since all you need for telehealth is a computer with audio/visual capabilities, public kiosks are starting to be made available. Convenient worksite solutions will be made available, where an employee can go into a room, consult a physician at the work site, and save hours of lost work time. Telemedicine is not appropriate for all treatments, but the speaker estimates that it will work for approximately 50% of claims.

The workers’ compensation industry still has some work to do as they adopt it:

• Legal challenges do exist.

• Determination of how bills will be paid needs to be established.

• The employer and claimant need to establish criteria as to how it would work.

• Criteria also needs to be established about appropriate use.

California has begun to use telemedicine and and can be used as a preliminary model for this potential game-changer.