California Office of Self-Insurance Plans Update

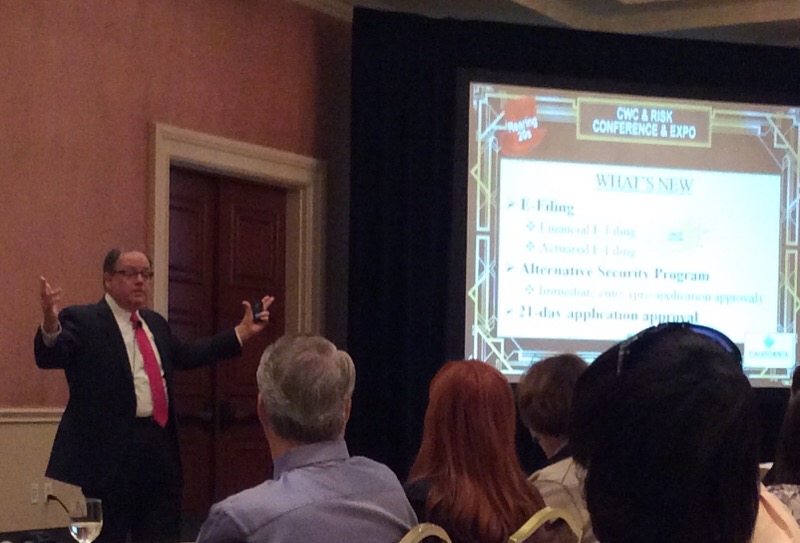

At the 2015 California Workers’ Compensation & Risk Conference, Jon Wroten, Chief at Office of Self-Insurance Plans, provided an status update on self-insurance in California, highlighting recent growth and future strategy for continuous improvement.

4.6 million California workers are covered by a self-insurance plan, which is a 15% increase over the last year. There is $192 billion of insured payroll, with 272,298 of total open claims.

Self insurance was designed to be an alternative. To be an alternative, it has to be attractive and business friendly in California. The numbers are starting to show that California is beginning to understand the benefits of self insurance. In 2011, California had zero new self-insurers coming into the system. In 2014-15, California has 15 new employers coming in, covering almost 50,000 employees and bringing in $10.2 billion in revenue.

This can be attributed to enhancing speed of business. Recently, California introduced financial and actuarial e-filing system. They have also created an alternative security program, written by the Self-Insurer Security Fund, which will guarantee the collateral required to self-insure, based on credit analysis. Previously, there was a three-year wait to take advantage of this. Currently, employees are granted immediate entry via pre-application approval. This makes it very simple to enter the self-insured market. Finally, The Office of Self-Insurance Plans is guaranteeing a 30-day approval period to become self-insured, averaging 21-day application approval.

Moving forward, The Office of Self-Insurance Plans is working on e-filing enhancements with annual report filing and greater use flexibility control for all parties, including the employer and TPA.

Dramatic reform is coming, with several regulations currently under review. The intent of this reform is adding integrity to the system by making it easier and faster to do business. They are working on eliminated long review periods and consolidating 21-page applications to five pages (with the intent that you will not have to write the same piece of information twice). They are working on enhancing sophisticated safeguards like enforcing strict underwriting criteria and collateral requirements, improving financial evaluations and audits with dual monitoring by OSIP & SISF, and improving actuarial studies by utilizing independent actuaries who have no financial interest in the organization that they are reviewing.